MODEL OVERVIEW

User-friendly Excel model intended for the preparation of investment appraisals, including the impact of carbon pricing, for up to 3 investment options. The model helps to determine the financial viability and compare financial metrics for each investment option side by side, to assist the decision-making process.

The model follows good practice financial modelling principles and includes instructions, checks and input validations.

KEY OUTPUTS

The model is generic and not industry-specific. It computes a number of key appraisal metrics for proposed project or investment including:

- Total oneoff costs

- NPV

- IRR

- MIRR

- Accounting Rate of Return

- Payback

- Profitability Index

- Equivalent Annual Cost

Results also include tables showing the overall costs and benefits on a:

- Cash View – presents actual cash impacts of each investment option

- P&L View – presents P&L impacts of each investment option (eg depreciation for capitalizable investments rather than cash impact)

The Results tab also includes charts showing the cumulative net cash flow and net earnings over the investment period.

KEY INPUTS

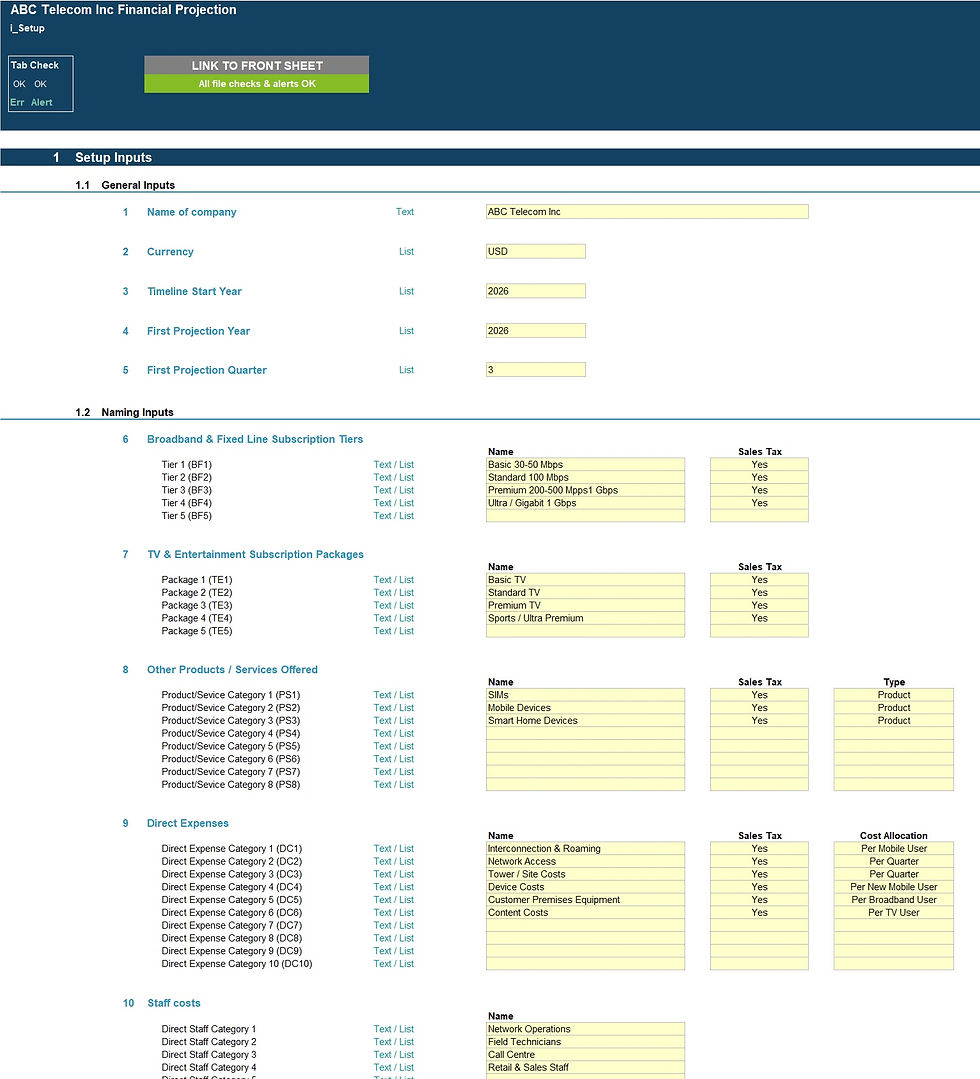

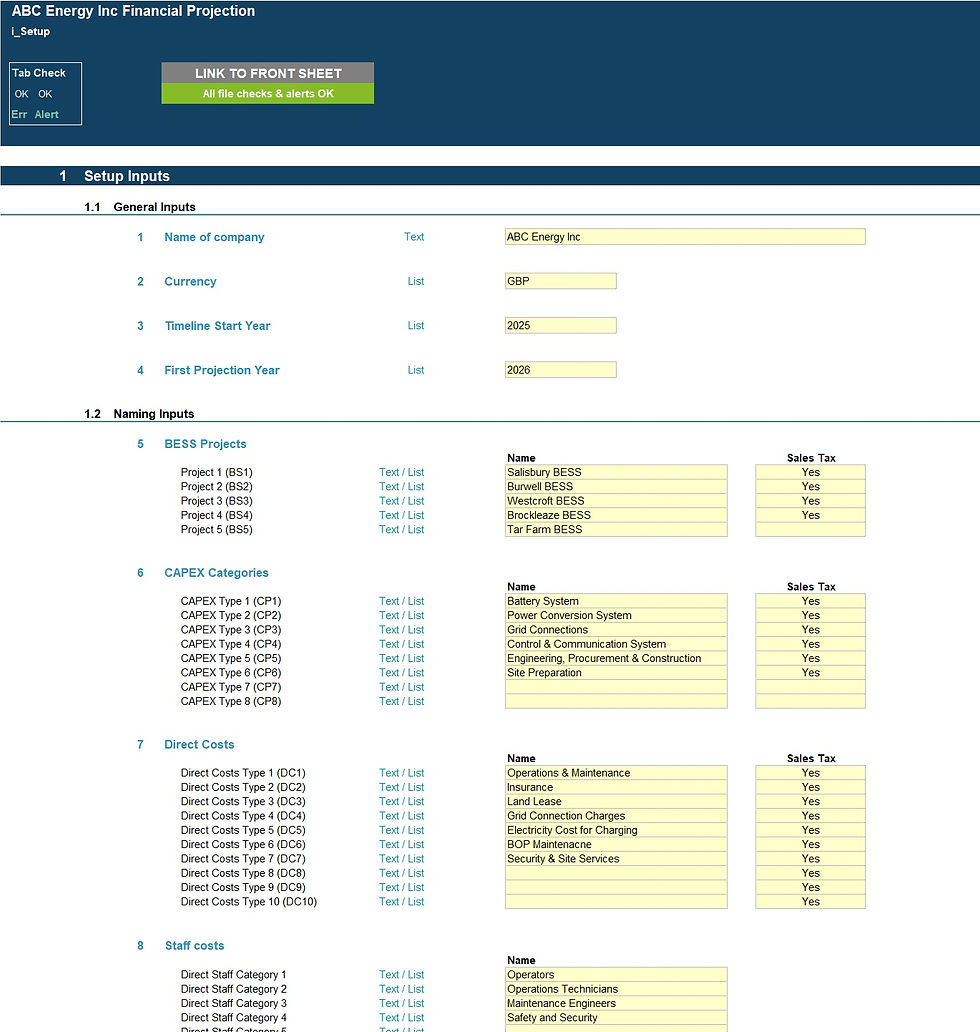

General inputs are further split into:

- Company Name

- Currency

- Fist Projection Year

- Cost of Capital

- Corporate tax rate and payment assumptions

- Carbon tax details and payment assumptions

Investment Inputs for up to 3 separate investment options including:

- Investment Name

- Investment Starting period & Lifetime

- Initial investment amount (split into Capitalisable and Noncapitalisable)

- Impact of investment on Revenues

- Impact of investment on Costs

- Variable costs % of Revenues

- Working capital % of Revenue

- Carbon emissions and related details

MODEL STRUCTURE

The model contains, 5 tabs split into input ('i_'), calculation ('c_'), output ('o_’) and system tabs. The tabs to be populated by the user are the input tabs are the input tab ('i_Assumptions'). The calculation tab uses the user-defined inputs to calculate and produce the projection outputs which are presented in ‘o_Results’ tab.

KEY FEATURES

Other key features of this model include the following:

- The model follows best practice financial modelling guidelines and includes instructions, line item explanations, checks and input validations;

- The model is not password protected and can be modified as required following download;

- The model allows the user to model the cost and benefits for up to 3 investment options across a maximum of 15 years with annual inputs;

- Business name, currency and starting projection period are customisable;

- The model includes a checks dashboard which summarises all the checks included in the various tabs making it easier to identify any errors;

- The model includes checks and input validations to help ensure input fields are populated accurately.

MODIFICATIONS & SUPPORT

If you require any be-spoke modifications or support, we are more than happy to assist. Please send us a message below or contact us on hello@useprojectify.com

Investment Appraisal Model with Carbon Pricing - Excel Models

1 Populated Excel Model and 1 Unpopulated Excel Model