MODEL OVERVIEW

User-friendly Excel model for compiling a capitalisation table for a startup or SME company showing the different shareholding percentages, voting percentages, equity valuations, investment return and IRR for different investors and across multiple investing rounds.

The model is flexible allowing the user to input up to 15 different investor group across 8 different capitalisation events and 3 different share capital classes (eg ordinary A, ordinary B and preference shares). Capitalisation events include new equity raises, SAFE or convertible bond conversions to equity, provision of stock options and share transfers.

The model follows best practice financial modelling principles and includes instructions, checks and input validations.

KEY OUTPUTS

- Breakdown of shareholding and voting rights by investor group

- Investment return and IRR by investor group

- Pre / Postmoney equity valuations across capitalisation events

- Share class splits across capitalisation events

KEY INPUTS

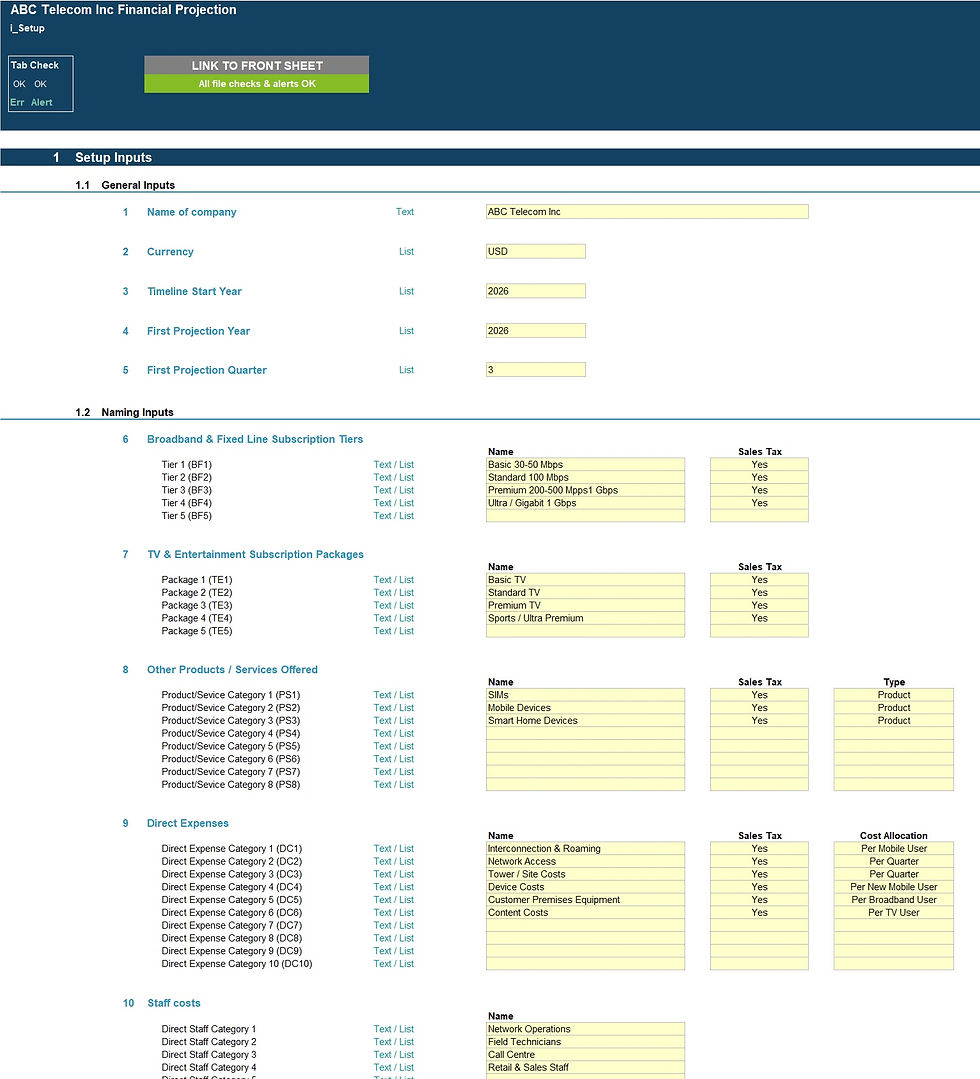

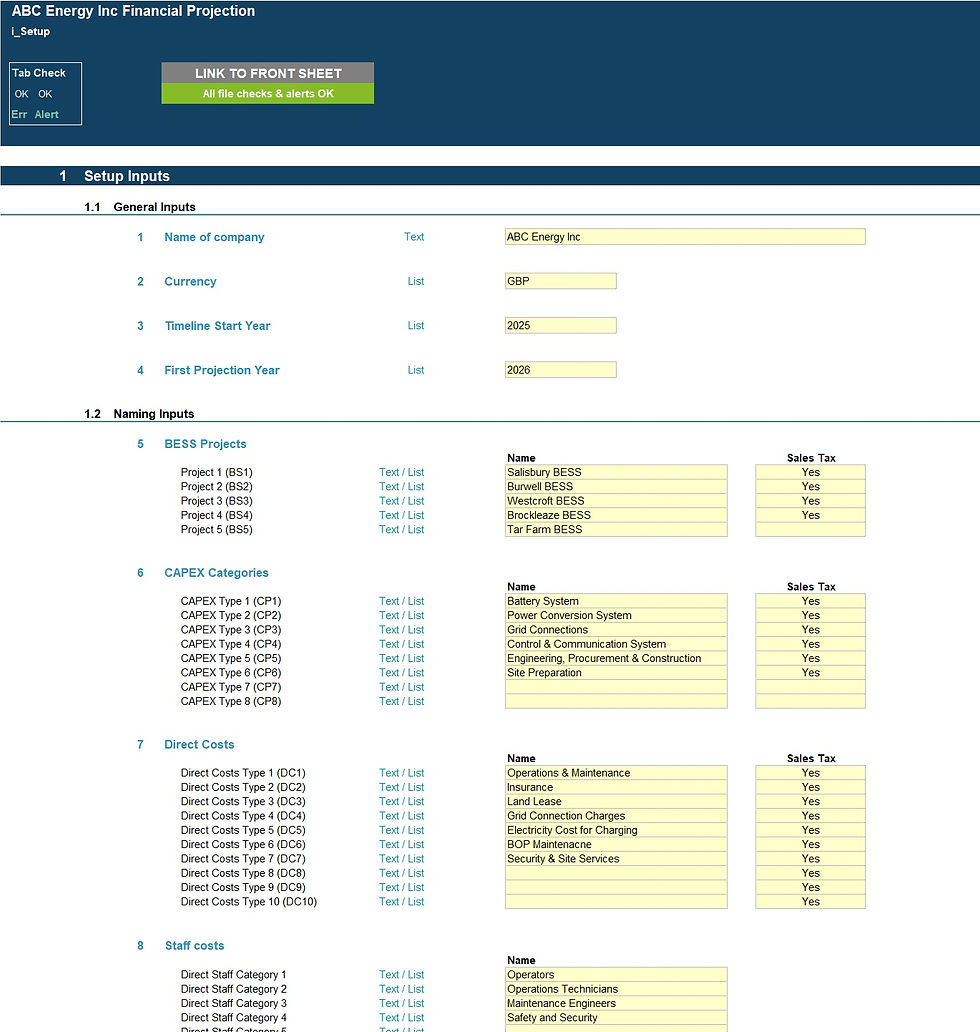

Setup inputs include:

- Business names

- Business currency

- Share capital classes including nominal value and voting rights per class

- Capitalisation events including name, date and type

- Investor group naming

Capitalisation event inputs include:

- Premoney equity valuations

- Equity investment amount or number of shares depending the capitalisation event type

- SAFE/Bond conversion price per share only applicable for SAFE/Bond equity conversions.

MODEL STRUCTURE

The model contains, 6 tabs split into input ('i_'), calculation ('c_'), output ('o_’) and system tabs. The tabs to be populated by the user are the input tabs ('i_Setup' and 'i_Assumptions'). The calculation tab uses the user-defined inputs to calculate and produce the cap table outputs which are presented in ‘o_Charts’

KEY FEATURES

- The model follows best practice financial modelling guidelines and includes instructions, checks and input validations;

- The model is not password protected and can be modified as required following download;

- The model is screened using specialised model audit software to help ensure formula consistency and significantly reduce risk of errors;

- -The model allows for the following number of underlying categories for each line item (these can be easily expanded if required):

- Capitalisation events – 8 events;

- Investor groups – 15 groups

- Share classes – 3 classes

- Capitalisation types – 4 types including equity raises, share transfers, stock options and SAFE/Bond equity conversions.

- Business Name and currency are fully customisable

- The model includes instructions, checks and input validations to help ensure input fields are populated accurately;

- The model includes a checks dashboard which summarises all the checks included in the various tabs making it easier to identify any errors.

MODIFICATIONS & SUPPORT

If you require any be-spoke modifications or support, we are more than happy to assist. Please send us a message below or contact us on hello@useprojectify.com

Startup / SME Capitalisation Table - Excel Model

1 Populated Excel Model and 1 Unpopulated Excel Model