MODEL OVERVIEW

Company valuation is the process of determining the economic worth of a business using methods such as income-based (e.g., discounted cash flow), market-based (e.g., comparable company analysis), or asset-based approaches. It involves analysing financial performance, risk factors, market conditions, and ownership structure, with adjustments for private companies such as discounts for lack of marketability (DLOM), control premiums, and size-related risk. The goal is to estimate a fair value that reflects the company's ability to generate future returns.

Our comprehensive company valuation model is designed for business owners and investors to estimate a business’s value based on user-defined assumptions within a structured, easy-to-use framework. It enables users to:

- Project future financial performance and position: with a 5year, fully integrated 3-statement forecast, incorporating assumptions for revenue growth, margins, operating and capital expenditures, working capital, and financing needs.

- Determine indicative business valuation: using multiple approaches (Discounted Cash Flow (DCF), Comparable Company Analysis, and Net Asset Value) while applying private companyspecific adjustments such as DLOM, control premiums, and size-related risk factors.

- Analyse and interpret valuation results: including weighted average valuations across methodologies, implied valuation multiples, and valuation breakdown by shareholder.

The model adheres to established best practices in financial modelling, with built-in instructions, validation checks, and error controls to ensure transparency, accuracy, and ease of use.

KEY OUTPUTS

- Key valuation outputs including intrinsic equity value and share price by valuation method and weighted combined value, valuation multiples (e.g. Priceto-Earnings Ratio),

- Valuation breakdown by shareholder

- Projected full financial statements (Income Statement, Balance Sheet and Cash flow Statement) across 5 years presented on a yearly basis for the company.

- Ratio Analysis based on projected financial statements

- Charts and graphs presenting summary valuation outputs and projected financials

KEY INPUTS

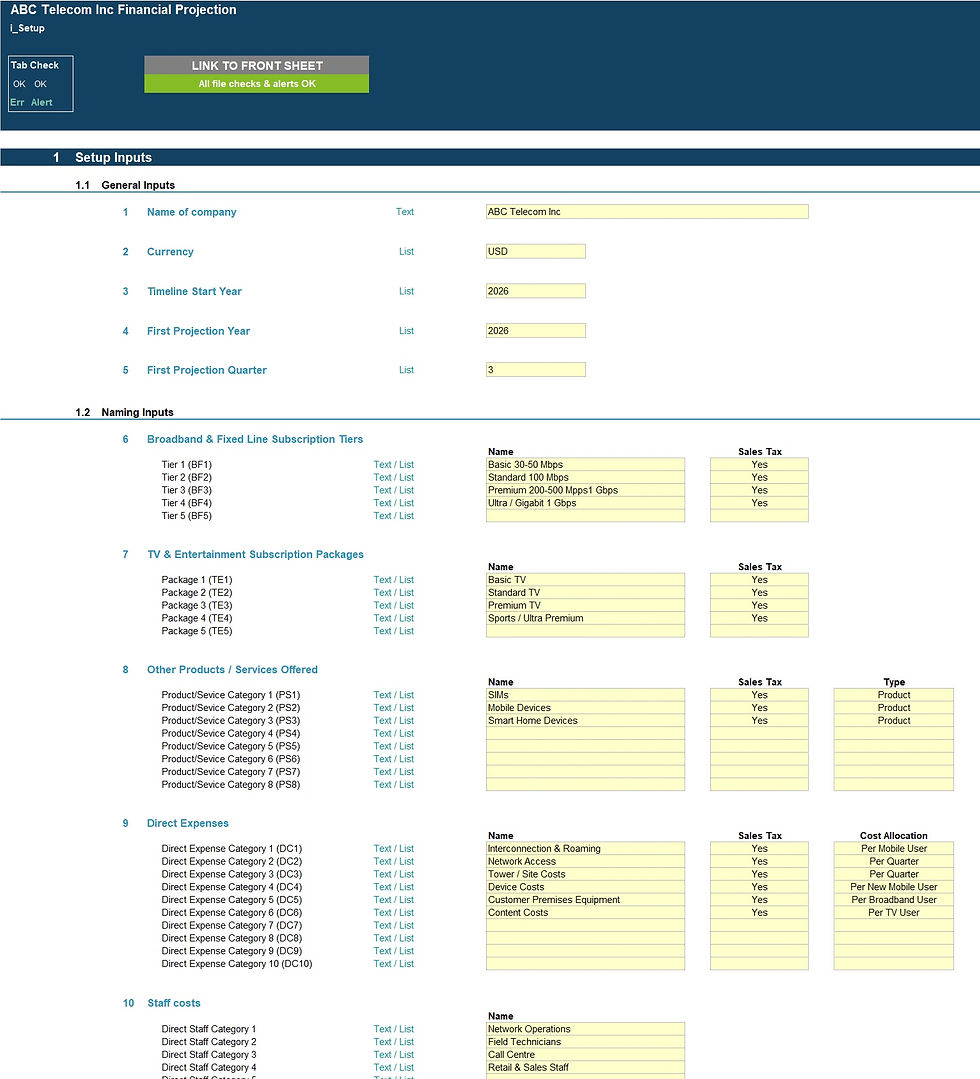

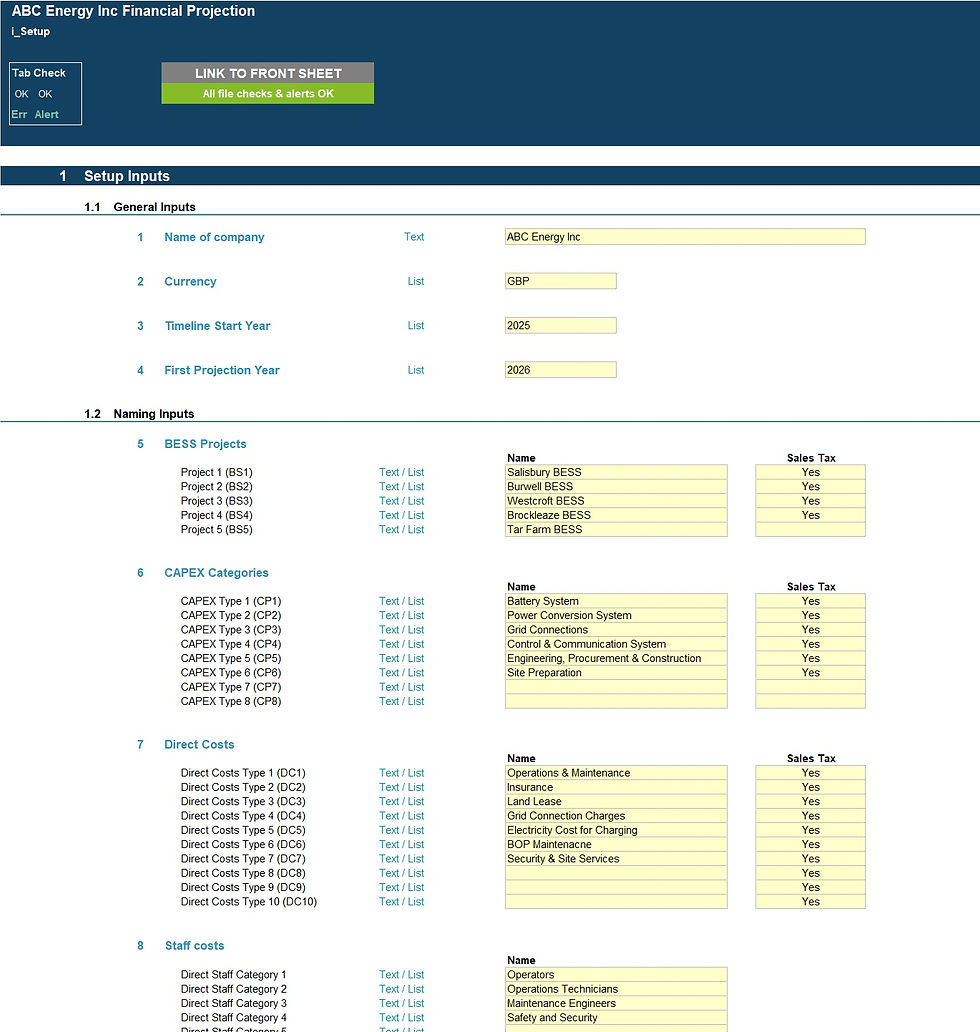

Setup Inputs:

- Name of company

- Currency;

- Valuation date

- Companies for comparative analysis;

- Naming for existing shareholders

Assumptions:

- Latest P&L and balance sheet actuals;

- Forecast income statement and balance sheet assumptions including

- Expected revenues and margins

- Expected operating and capital expenditures

- Working capital assumptions

- Financing assumptions including borrowings and dividend distributions

- Valuation inputs including:

- key financials for comparative companies,

- Discount rate inputs and terminal growth rates

- Private company valuation assumptions including DLOM, control premiums or minority discounts, size discounts.

- Net asset value adjustments including fair value adjustments, hidden or off-balance sheet liabilities and owner related adjustments.

MODEL STRUCTURE

The model comprises of 6 tabs split into input ('i_'), calculation ('c_'), output ('o_’) and system tabs. The tabs to be populated by the user are the input tabs which include ‘i_Setup’ for model setup details and ‘i_Assumptions for specific projection and valuation assumptions relating to the company. The calculation tab uses the user-defined inputs to calculate and produce the projection and valuation outputs which are presented in the calculation tabs and ‘o_Dashboard’ tab.

KEY FEATURES

- The model follows good practice financial modelling guidelines and includes instructions, checks and input validations to help ensure input fields are populated accurately;

- The model enables the user to prepare projections across 5 years and valuations for the business

- The model is not password protected and can be modified as required following download;

- Apart from projecting revenue and costs the model includes the possibility to model receivables and payables, inventory, fixed assets, borrowings, dividends and corporate tax;

- Business name, currency, timeline and valuation date are fully customisable;

- The model includes valuation calculations using 3 approaches with user-defined weights for each approach:

- Discounted cash flow (DCF) basis,

- Comparative company analysis basis and

- Adjusted net asset valuation basis

- The model includes a checks dashboard which summarises all the checks included in the various tabs making it easier to identify any errors.

SUPPORT / MODIFICATIONS

We are keen to ensure our customers are satisfied and find the models useful for their financial projection needs. Our models are developed with the user in mind and include instructions, line-item explanations, checks and input validations to ensure they are as user-friendly and easy to use as possible without requiring extensive knowledge of Microsoft Excel, finance or accounting. If any questions do arise, we are more than happy to assist. We are also happy to support with any be-spoke modifications you may require to the models to better suit your business needs. To get in touch, please send us a message through the website or contact us on: hello@useprojectify.com

We are also always keen to receive feedback so please do let us know what you think of our models by sending us a message or submitting a review.

Generic Company Valuation Excel Financial Model

1 Populated Excel Model and 1 Unpopulated Excel Model