MODEL OVERVIEW

A project finance model for R&D is a financial model used to assess the viability, funding needs, and return potential of a stand-alone R&D project (e.g. structured as an SPV or ring-fenced initiative). It tracks cash flows, grants, and investment needs, and shows key metrics like total project cost, grant leverage, IRR, NPV, and peak funding. It is especially useful in biotech, cleantech, and deep-tech sectors where funding is staged, high-risk, and often externally subsidized.

Our flexible and user-friendly R&D project finance model enables users to build full 3-statement financial projections over an 8-year period, across 3 scenarios with the option to apply probability-adjusted progression across development stages. Designed to assess the viability of new or existing R&D projects, the model supports multiple development stage, such as research, preclinical, clinical, regulatory, and commercialization and is particularly suited to biotech and deep-tech use cases.

The model features detailed stage-based research cost inputs, capitalised development costs, license and royalty revenue, staffing, grants, fixed assets and taxes. Built with best-practice modelling standards, it includes DCF valuation, key project finance metrics (IRR, NPV, payback), input guidance, built-in checks, and clear documentation making it ideal for use by Biotech / Medtech / Deep-tech startups, venture capital / life science investors, universities & research institutes, public funding agencies and tech transfer offices.

KEY OUTPUTS

- Projected full financial statements (Income Statement, Balance Sheet and Cash flow Statement) presented on a monthly basis across up to 5 years and summarised on an annual basis.

- Financial feasibility metrics including total R&D spend, grant coverage ratio, IRR, NPV, Payback period, peak funding requirement and royalty coverage ratio;

- Dashboard with:

- Summarised projected Income Statement and Balance Sheet;

- Compounded Annual Growth Rate (CAGR) for each summarised income statement and balance sheet line item;

- Key ratios including average revenue growth, average profit margins, average return on assets and equity and average debt to equity ratio;

- Charts and graphs showing: cash balance by month, free cash flow generation, cash flow statement breakdown, profit margins, income statement breakdown, net cash vs net income, working capital, valuation and capital structure.

- Discounted cash flow valuation using the projected cash flow output.

KEY INPUTS

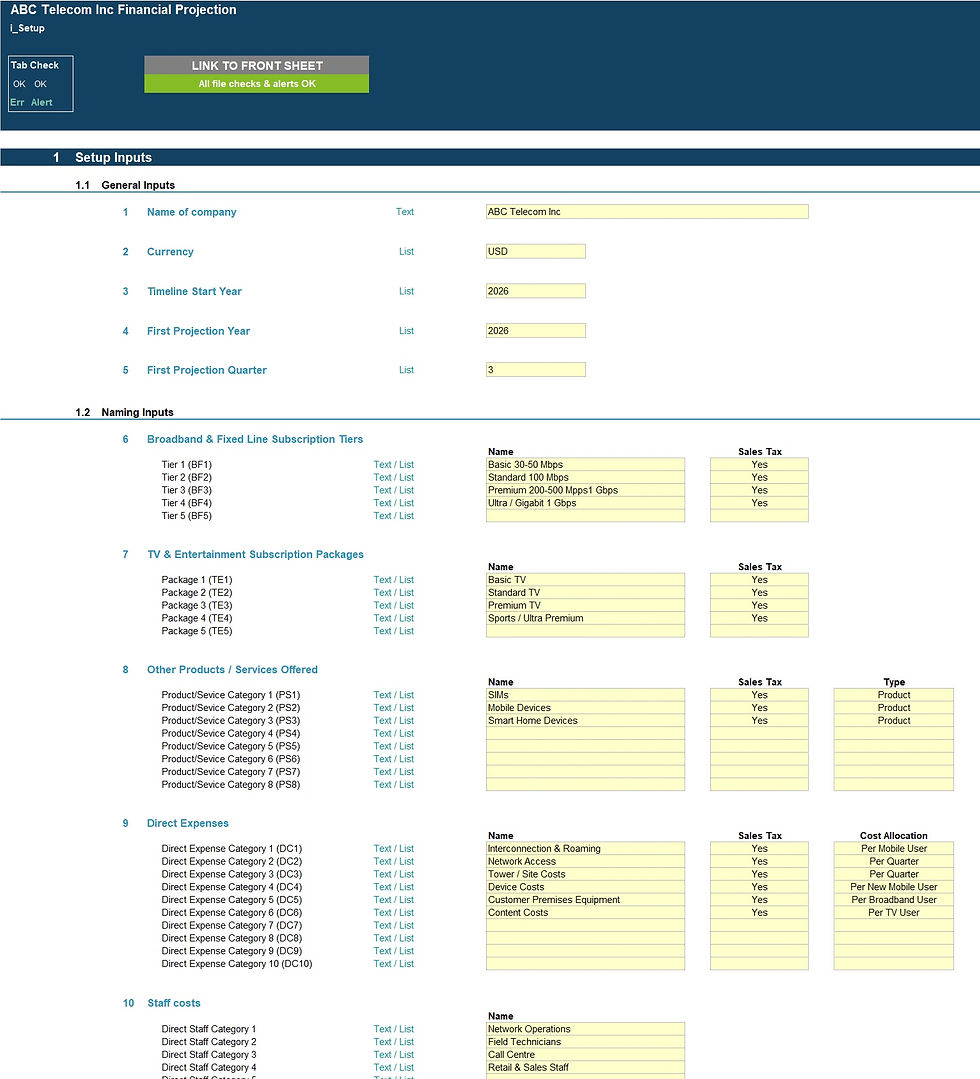

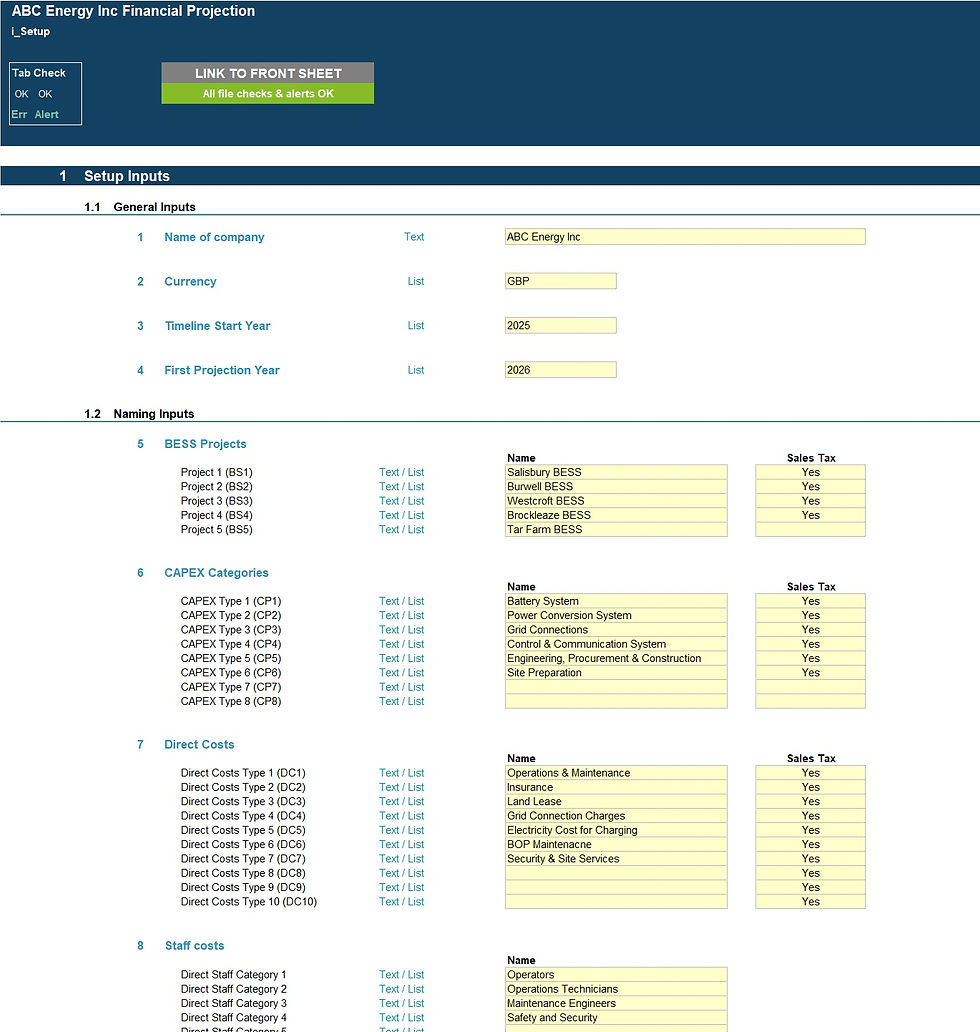

Setup Inputs:

- Name of business/project;

- Currency;

- First projection year and month;

- Naming for project phases, scenarios, R&D costs, staff categories, other expenses, fixed assets, grants and borrowings;

- Sales tax applicability for revenue, expense and fixed asset items.

Actuals Inputs:

- Opening balance sheet (for existing projects);

- Income Statement actuals (for trend analysis);

Projection Inputs:

- Royalty revenue including probabilities of progression across development stages, stage duration in months, royalty rates, product demand and credit terms offered;

- Licence fee revenue;

- R&D spend for each development stage;

- Other costs inputs including staff costs and other expenses;

- Sales and corporate tax inputs including rate and payment periods;

- Dividend inputs including amount (percentage of retained earnings) and frequency;

- Fixed assets including addition amounts and useful life;

- Borrowings including addition amounts, interest rate and maturity date;

- Grants including funding amounts, applicable phase and payment timing;

- Share capital additions;

- Discount rate inputs (for valuation calculation).

MODEL STRUCTURE

The model comprises of 9 tabs split into input ('i_'), calculation ('c_'), output ('o_’) and system tabs. The tabs to be populated by the user are the input tabs ('i_Setup', ‘i_Actuals’ and 'i_Assumptions'). The calculation tab uses the user-defined inputs to calculate and produce the projection outputs which are presented in 'o_Fin Stats', ‘o_Dashboard’ and ‘o_DCF’.

KEY FEATURES

- The model contains a flexible timeline that allows for a mix of Actual and Forecast period across an 8-year period with ability to roll-forward projections;

- Timeline is split on a monthly basis and summarised on an annual basis;

- The model includes the option to apply probability-adjusted progression across development stages for revenues, costs and financing.

- The model is not password protected;

- The model allows for the following number of underlying categories for each line item (these can be easily expanded if required):

- Development stages – 5 stages (2 research, 2 development and 1 commercialisation stage)

- Scenarios – 3 scenarios

- Research Costs – 10 categories

- Development Costs – 10 categories

- Staff Costs – 10 R&D Staff categories and 10 non-R&D staff categories

- Other expenses – 15 categories;

- Fixed assets – 6 categories (including capitalisation of development costs);

- Grants – 5 grant types;

- Borrowings – 5 facilities.

- Apart from projecting royalty and licensing revenue, R&D spend and expenses the model includes the functionality to model accounts receivable, fixed assets, borrowings (amortising), grants, dividends, capital additions and corporate tax;

- Business name, currency, starting projection period are fully customisable;

- Revenue, cost and fixed asset descriptions are fully customisable;

- The model included an integrated discounted cash flow valuation and financial feasibility metrics using the projected cash flow outputs

- The model includes instructions, line-item explanations, checks and input validations to help ensure input fields are populated accurately;

- The model includes a checks dashboard which summarises all the checks included in the various tabs making it easier to identify any errors.

MODIFICATIONS & SUPPORT

If you require any be-spoke modifications or support, we are more than happy to assist. Please send us a message below or contact us on hello@useprojectify.com

Project Finance for R&D Excel Financial Model

1 Excel model with populated example and 1 blank Excel model