BESS MODEL OVERVIEW

A BESS (Battery Energy Storage System) business develops, owns, or operates battery systems that store electricity when it’s cheap or abundant and release it when the grid needs it. It earns revenue through energy arbitrage, capacity payments, and grid support services, turning battery flexibility and reliability into a commercial asset.

Our highly versatile and user-friendly Excel model enables the preparation of a 20-year rolling 3-statement (Income Statement, Balance Sheet, and Cash Flow Statement) financial projection with an annual timeline. It supports a mix of actual and forecast periods, making it suitable for both new BESS developments and existing operating portfolios. The model also accommodates up to five distinct BESS projects, each at different lifecycle stages, including pipeline/forecast and in operation.

The model incorporates key BESS-specific functionality, including:

- Revenue modelling for energy arbitrage and capacity/availability payments.

- Battery performance assumptions, including cycles, throughput, degradation, round-trip efficiency and availability.

- Comprehensive CAPEX schedules including depreciation, asset lives, and future replacement additions.

- Detailed OPEX projections, including direct and indirect staff costs and operating costs

- Borrowings and financing, including debt drawdowns, interest, repayments, and equity funding additions.

- Corporate tax, sales tax/VAT treatments and dividend distributions.

The model follows good-practice financial modelling principles and includes clear instructions, line-item explanations, built-in checks, and input validations.

BESS MODEL KEY OUTPUTS

- Projected full financial statements (Income Statement, Balance Sheet and Cash flow Statement) presented on an annual basis across 5 years.

- Dashboard with:

- Summarised projected Income Statement and Balance Sheet.

- Compounded Annual Growth Rate (CAGR) for each summarised income statement and balance sheet line item.

- Key ratios including average revenue growth, average profit margins, average return on assets and equity and average debt to equity ratio.

- Tables and Bar charts summarising revenue and gross profit by mining location.

- Charts and graphs showing: cash balance by month, free cash flow generation, cash flow statement breakdown, profit margins, income statement breakdown, net cash vs net income, working capital, valuation and capital structure.

- Discounted cash flow valuation using the projected cash flow output.

- Breakeven analysis

BESS MODEL KEY INPUTS

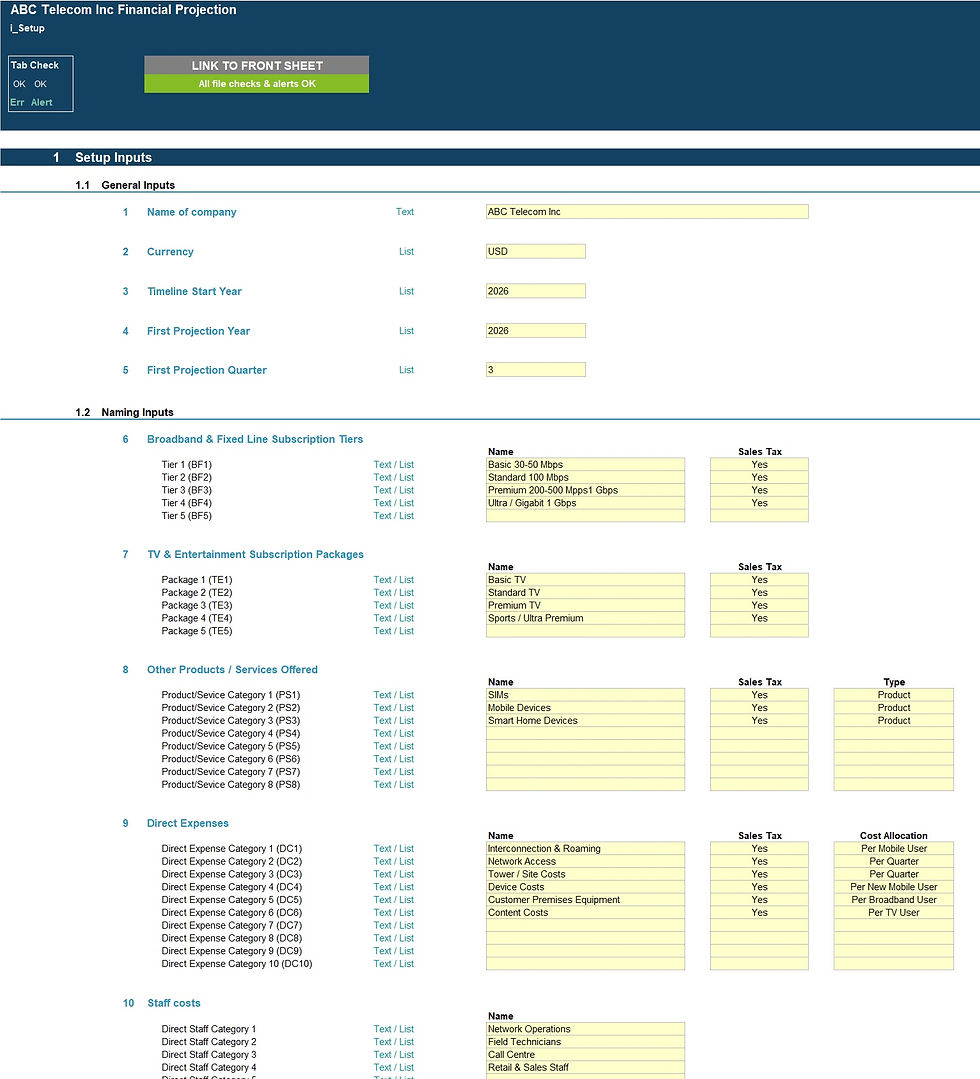

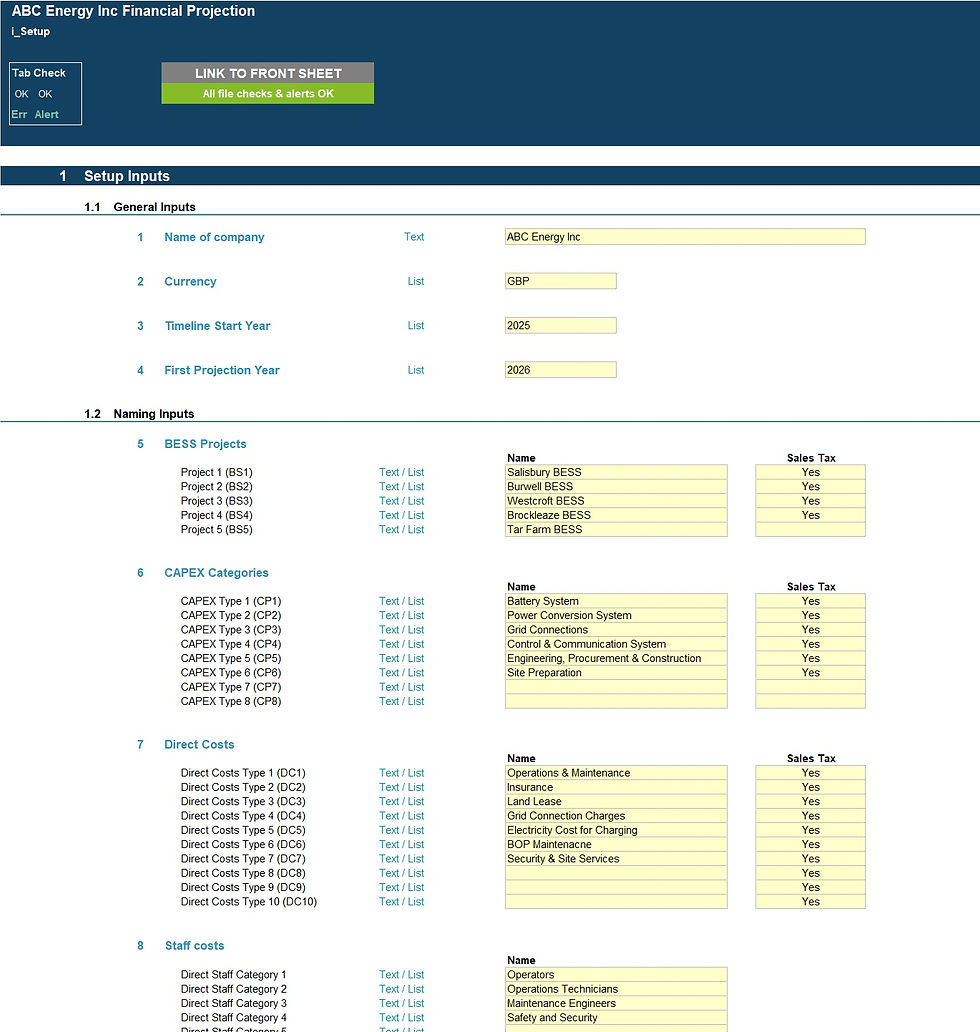

Setup Inputs:

- Name of business.

- Currency.

- Timeline start year and first projection year.

- Naming for BESS projects, CAPEX and OPEX cost categories, staff cost categories and borrowings.

Actuals Inputs:

- Opening balance sheet (for existing businesses);

- Income Statement actuals (for trend analysis);

Projection Inputs:

- BESS project general assumptions: lifecycle status, project start year, total project lifetime, installed power capacity (MW), maximum energy capacity (MWh), battery degradation, charge/discharge cycles per day, round-trip efficiency (RTE) and system availability.

- Revenue assumptions: energy arbitrage pricing and capacity market revenue.

- Direct operating cost assumptions expressed on a per MW per year.

- Direct labour: annual full-time equivalent (FTE) requirements for operational staffing

- CAPEX assumptions including useful life assumptions, addition amounts and timing of additions.

- Other operating costs: non-direct staff costs and additional site or corporate operating expenses.

- Tax inputs: sales tax and corporate tax rates, timing and payment periods.

- Dividend policy: distributions based on fixed amounts or a percentage of retained earnings.

- Borrowings: new debt drawdowns, interest rates and repayment profiles.

- Share capital: planned equity injections.

- Valuation inputs: discount rate assumptions for DCF valuation.

BESS MODEL KEY FEATURES

- The model contains a flexible timeline that allows for a mix of actual and forecast periods across a 20-year period. This allows projections to be easily rolled forward as forecast periods become actual period.

- The model is not password protected and can be modified as required following download.

- The model allows the user to model up to 5 BESS projects (both existing and new) with own assumptions for lifecycle stage, revenue, direct costs, CAPEX, and direct labour usage.

- The model allows for the following number of underlying categories for each line item (these can be easily expanded if required):

- BESS projects – 5 projects.

- Direct costs – 10 categories.

- Staff costs – 8 direct staff categories and 8 non-direct staff categories.

- Development Costs – 10 categories (split soft and hard).

- Other expenses – 15 categories.

- Borrowings – 5 facilities.

- Apart from projecting revenue and costs the model includes the possibility to model, development costs, borrowings (amortising), dividends and corporate tax.

- Business name, currency, starting projection period and revenue and cost naming are fully customisable.

- The model included an integrated discounted cash flow valuation using the projected cash flow outputs.

- The model includes instructions, line-item explanations, checks and input validations to help ensure input fields are populated accurately.

- The model includes a checks dashboard which summarises all the checks included in the various tabs making it easier to identify any errors.

SUPPORT / MODIFICATIONS

If you require any be-spoke modifications or support, we are more than happy to assist. Please send us a message below or contact us on hello@useprojectify.com

BESS (Battery Energy Storage System) Financial Projection Model

1 Excel model with populated example and 1 blank Excel model