MODEL OVERVIEW

A debt fund is an investment vehicle that provides loans to businesses companies or asset-backed borrowers, typically generating returns through interest income and fees rather than equity ownership. Debt funds generally offer lower volatility, earlier cash distributions and more predictable cash flows, while still targeting attractive risk-adjusted returns.

Our highly versatile and user-friendly Excel-based financial model is designed for the preparation of a private debt fund three-statement financial projection on a quarterly and annual timeline of up to 10 years.

The model allows the user to model up to 25 individual debt investments (loans) with flexible, loan-level assumptions, including:

- Loan principal, interest rate and term

- Bullet, partially amortising or fully amortising repayment structures

- Early repayment and expected credit losses.

- Transaction costs

- Leverage assumptions

Interest income, fee income and credit losses are aggregated at fund level to produce realistic portfolio-level cash flows and NAV calculations.

The model also enables the user to model other financial instruments (money market, bonds, equities, alternatives etc), transaction fees, asset management fees, staff costs, operating expenses, fixed assets and borrowings.

In addition, the model incorporates fund-level cash flow mechanics and investor return calculations, including capital contributions and distributions between Limited Partners (LPs) and the General Partner (GP), with a fully flexible waterfall structure covering:

- Equity contribution splits

- LP preferred return / hurdle rates

- GP catch-up provisions

- Carried interest calculations

KEY OUTPUTS

- Projected full financial statements (Income Statement, Balance Sheet and Cash flow Statement) presented on a quarterly basis across 10 years and summarised on an annual basis.

- Dashboard with:

- Summarised projected Income Statement and Balance Sheet;

- List of key ratios including average investment return, average profit margins, average return on assets and equity and average debt to equity ratio;

- Bar charts summarising income statement and Balance Sheet projections;

- Waterfall of fund distributions

- IRR on total fund basis and for GP and LP

- IRR and net cash flows by debt investment

- Multiples of invested capital (MOIC)

- Charts presenting total assets under management, NAV plus distributions and investment income.

KEY INPUTS

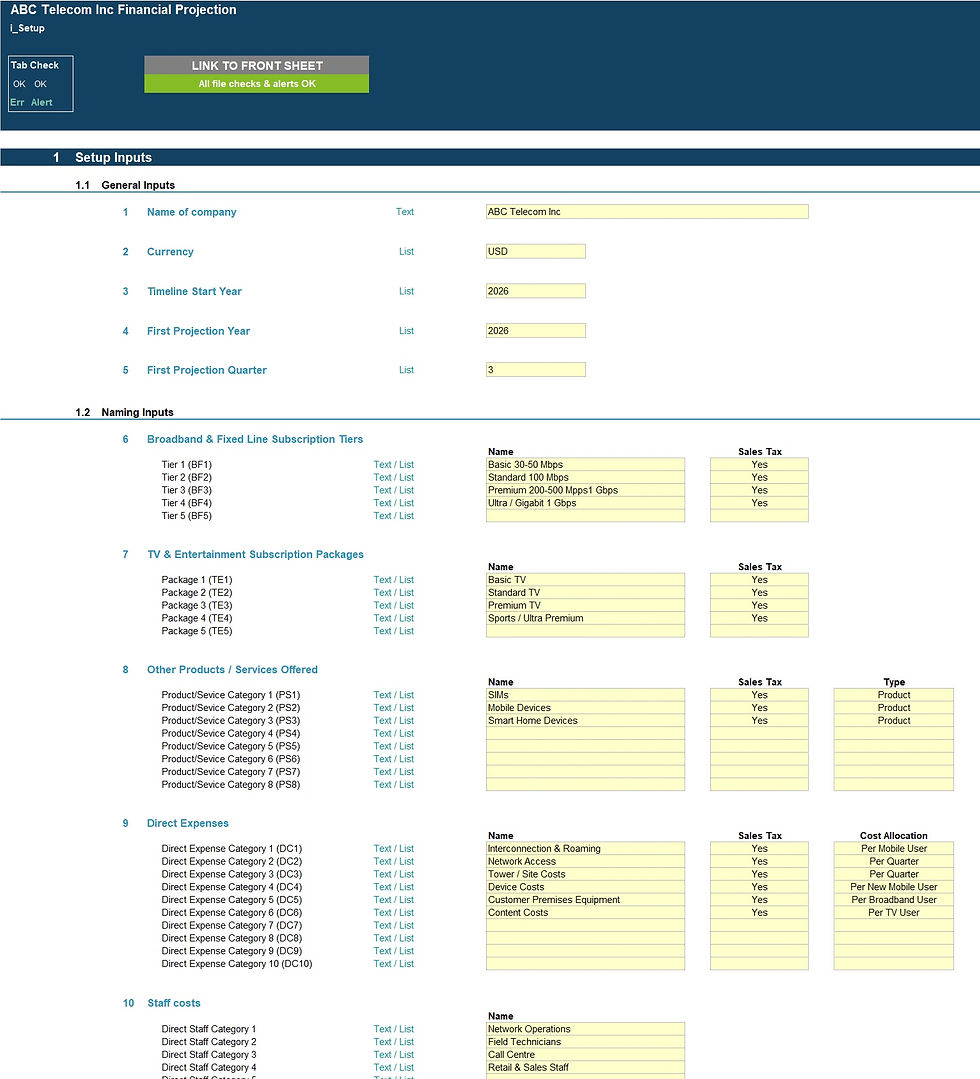

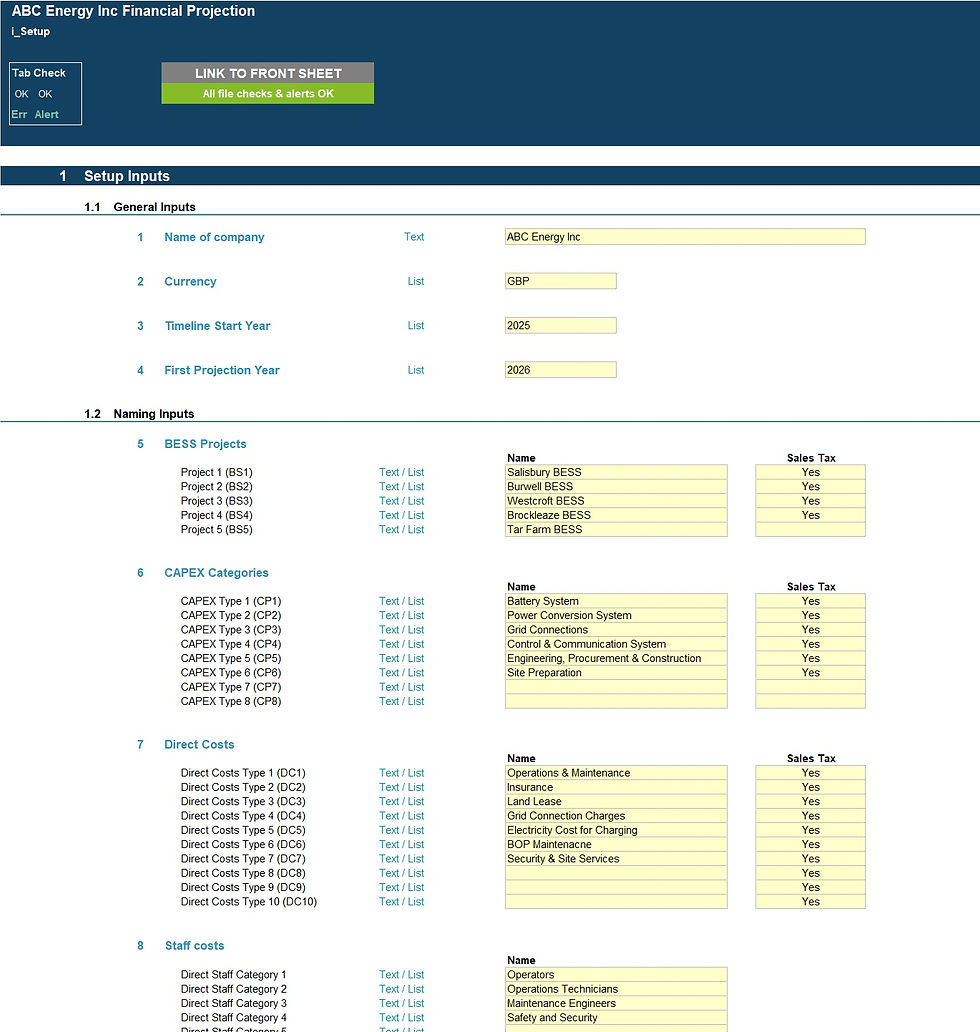

Setup Inputs:

- Name of business;

- Currency;

- First projection year and quarter;

- Naming for debt investments, financial investments, staff costs, other expenses, financial investments and fixed assets.

Projection Inputs:

- Debt Investments:

- Loan principal and term

- Interest rate per annum

- Transaction cost %

- Early repayment %

- Credit loss %

- Leverage % and interest rate

- Financial Investment Assumptions

- Investment Return per Annum;

- Target Cash Balances;

- Investment Allocation percentages;

- Transaction cost %;

- Other cost inputs including

- Staff costs;

- Other operating costs;

- Corporate tax inputs including rate and payment periods;

- Fixed Assets including addition amounts and useful life;

- Capital contributions and distributions;

- Distribution waterfall assumptions:

- GP and LP equity contribution splits

- LP hurdle rates

- GP catch up provisions and carried interest

- GP and LP excess return splits

KEY FEATURES

- The model follows best practice financial modelling guidelines and includes instructions, checks and input validations;

- The model is not password protected and can be modified as required following download;

- The model includes an 8-year timeline split on a monthly basis and summarised on an annual basis;

- The model allows for the following number of underlying categories for each line item (these can be easily expanded if required):

- Debt investments – 25 investments

- Financial Investments – 5 categories

- Staff costs – 8 categories;

- Other expenses – 15 categories;

- Fixed Assets – 5 categories;

- Borrowings – 3 facilities;

- Apart from projecting revenue and costs the model includes the possibility to model, financial investments, fixed assets, borrowings, corporate tax and distribution waterfall.

- Fund details, currency, starting projection period are fully customisable;

- Revenue, cost and fixed asset category descriptions are fully customisable;

- The model includes instructions, checks and input validations to help ensure input fields are populated accurately;

- The model includes a checks dashboard which summarises all the checks included in the various tabs making it easier to identify any errors.

SUPPORT / MODIFICATIONS

If you require any be-spoke modifications or support, we are more than happy to assist. Please send us a message below or contact us on hello@useprojectify.com

Debt Fund Financial Projection Excel Model

1 Blank Excel model and 1 Excel model with populated example