MODEL OVERVIEW

Highly versatile and user-friendly Excel model for the p reparation a of 5-year rolling 3 statement (Income Statement, Balance Sheet and Cash flow Statement) financial projection with a monthly timeline across 3 scenarios for a generic new or existing business. The model allows businesses to plan for uncertainty across the turbulence caused by the COVID-19 pandemic.

The model follows good practice financial modelling principles and includes instructions, line item explanations, checks and input validations.

KEY OUTPUTS

The model is generic and not industry-specific. The key outputs include:

- Projected full financial statements (Income Statement, Balance Sheet and Cash flow Statement) for all 3 scenarios, presented on a monthly basis across up to 5 years and summarised on an annual basis.

- Dashboard with:

- Summarised projected Income Statement and Balance Sheet for each of the scenarios;

- Compounded Annual Growth rate (CAGR) for each summarised income statement and Balance Sheet line item for each of the scenarios;

- List of key ratios including Average revenue growth, Average profit margins, Average return on assets and equity and Average Debt to Equity ratio for each of the 3 scenarios;

- Bar charts summarising income statement and Balance Sheet projections for each of the scenarios;

- Gross Profit margin by revenue stream in table and bar-chart format for each of the 3 scenarios.

- Variance analysis across the 3 scenarios with bar charts comparing: revenue, net profit, total assets and net assets for the 3 scenarios.

KEY INPUTS

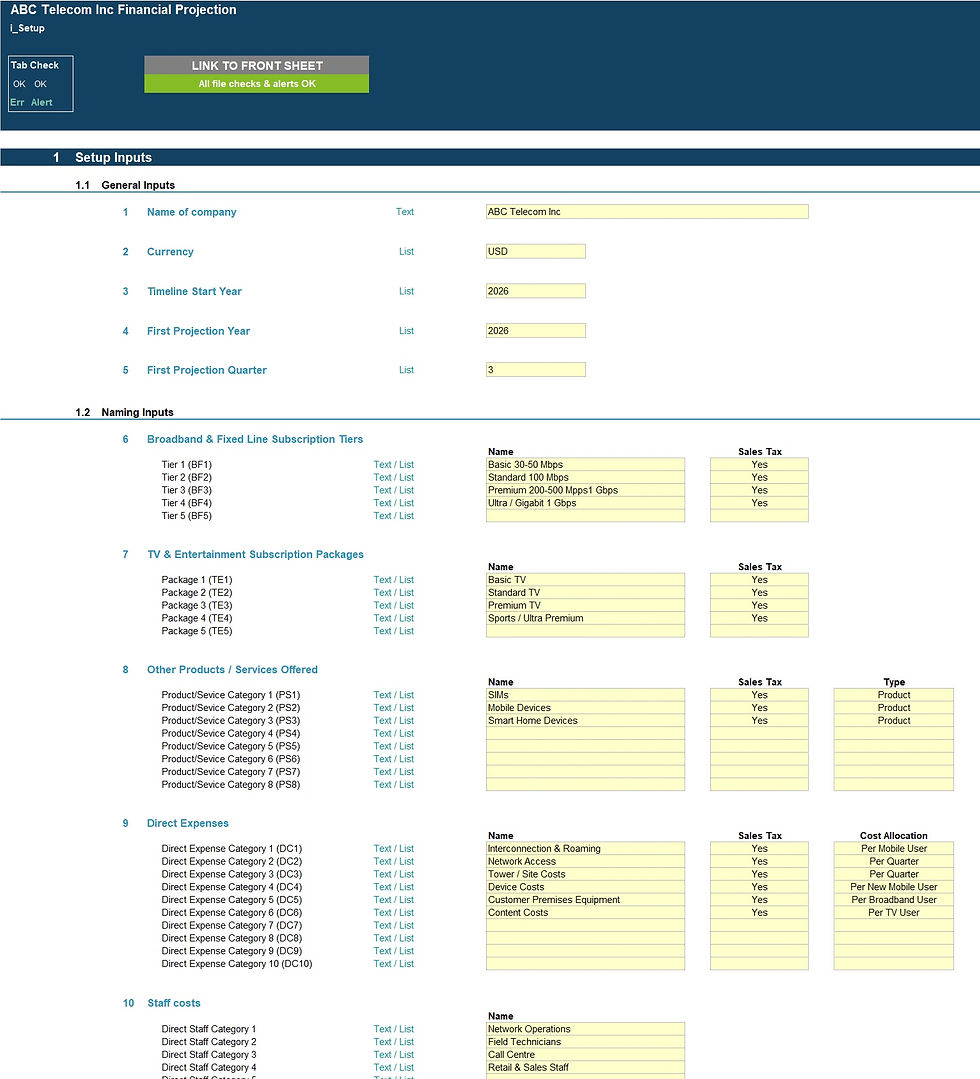

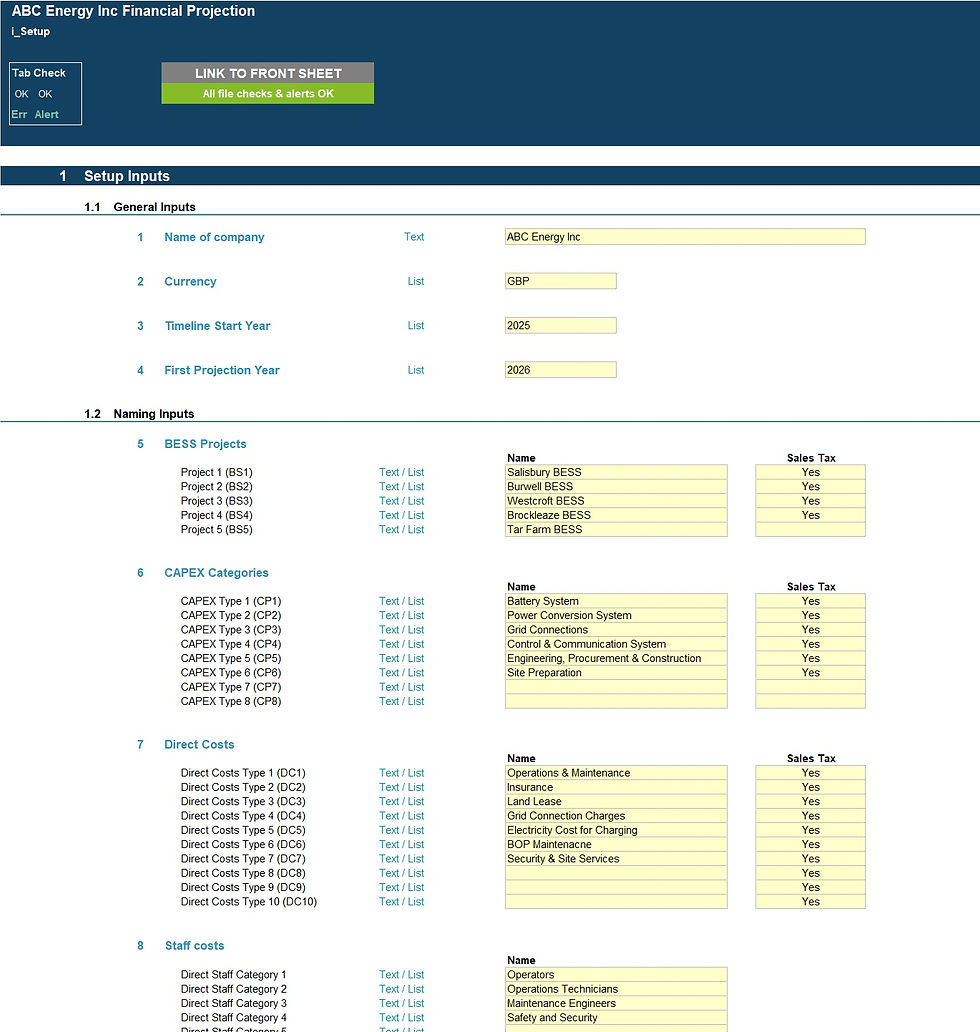

Setup Inputs:

- Name of business;

- Currency;

- First projection year and month;

- Naming of scenarios

- Naming for revenue streams, variable costs, staff costs, other expenses and fixed assets;

- Sales tax applicability for revenue streams, variable costs, other expenses and fixed assets.

Actuals Inputs:

- Opening balance sheet (for existing businesses);

- Income Statement actuals (for trend analysis);

Projection Inputs for each of the 3 scenarios:

- Revenue inputs including sales volume, sales prices and average credit terms offered;

- Cost of goods sold included percentage of revenue, safety stock percentage and average credit terms received;

- Variable cost inputs including % of revenue applicable to and cost percentage of revenue

- Other costs inputs including staff costs, marketing costs and fixed costs;

- Sales and corporate tax inputs including rate and payment periods;

- Dividend inputs including amount (percentage of retained earnings) and frequency;

- Fixed Assets including addition amounts and useful life;

- Borrowings including addition amounts and interest rate;

- Share Capital additions;

- Discount rate inputs (for valuation calculation).

MODEL STRUCTURE

The model comprises of 12 tabs split into input ('i_'), calculation ('c_'), output ('o_’) and system tabs. The tabs to be populated by the user are the input tabs ('i_Setup', ‘i_Actuals’, 'i_Assump_S1', 'i_Assump_S2' and , 'i_Assump_S3'). The calculation tab uses the user-defined inputs to calculate and produce the projection outputs which are presented in 'o_Fin Stats' and ‘o_Dashboard’.

KEY FEATURES

- The model follows good practice financial modelling guidelines and includes instructions, line item explanations, checks and input validations;

- The model contains a flexible timeline that allows for a mix of actual and forecast period across a 5-year period. This allows projections to be easily rolled forward;

- Timeline is split on a monthly basis and summarised on an annual basis;

- The model allows the user to model 10 separate revenue streams on a Price x Volume basis;

- The model is not password protected and can be modified as required following download;

- The model is reviewed using specialised model audit software to help ensure formula consistency and significantly reduce risk of errors;

- Costs are split into: variable and other costs for better driver-based forecasting;

- The model allows for the following number of underlying categories for each line item (these can be easily expanded if required):

- Scenarios – 3 scenarios

- Revenue streams – 10 categories;

- Cost of goods sold – 1 category for each revenue stream (10 categories in total);

- Variable costs – 5 categories

- Staff costs – 8 categories;

- Marketing costs – 5 categories;

- Other expenses – 15 categories;

- Fixed assets – 5 categories;

- Borrowings – 3 facilities

- Apart from projecting revenue and costs the tool includes the possibility to model receivables and payables, fixed assets, borrowings, dividends and corporate tax;

- Business Name, currency, starting projection period and scenario names are fully customisable;

- Revenue, Cost and Fixed Asset descriptions are fully customisable;

- The model included an integrated discounted cash flow valuation using the projected cash flow outputs;

- The model includes instructions, line item explanations, checks and input validations to help ensure input fields are populated accurately;

- The model includes a checks dashboard which summarises all the checks included in the various tabs making it easier to identify any errors.

MODIFICATIONS & SUPPORT

If you require any be-spoke modifications or support, we are more than happy to assist. Please send us a message below or contact us on hello@useprojectify.com